Empowering Financial Inclusion: How Latest Microfinance Software is Transforming India

Microfinance has long been a pillar of financial inclusion in India, helping individuals and small businesses in underserved communities access the funds they need to grow and thrive. As the industry continues to evolve, the need for efficient and scalable microfinance software has never been greater. Microfinance institutions (MFIs) across India are now turning to advanced technology to streamline their operations, improve customer experience, and ensure regulatory compliance.

In this blog post, we’ll explore the role of microfinance software in transforming the sector, and how cutting-edge solutions like microfinance loan management systems, cloud-based microfinance software, and digital microfinance tools are empowering institutions and their customers alike.

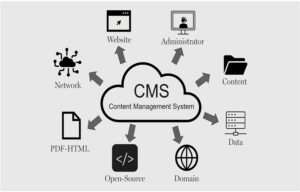

What is Microfinance Software?

Microfinance software is designed to address the unique needs of microfinance institutions, which often cater to underserved and rural populations in India. Unlike traditional banking software, microfinance software focuses on managing small loans, customer data, accounting, and compliance. It helps MFIs deliver financial services more efficiently and with greater transparency.

These software solutions enable institutions to manage multiple facets of their operations, including:

- Loan applications and disbursement

- Repayment tracking and customer interactions

- Risk management and compliance

- Financial reporting and accounting

With a strong focus on automating manual tasks, microfinance software allows MFIs to improve efficiency and reduce operational costs, ultimately enabling them to serve more clients while maintaining a high level of service.

Key Features of Latest Microfinance Software

The best microfinance software solutions available in India come packed with features that enhance every aspect of microfinance operations. Let’s dive into some of the core features that set these platforms apart.

1. Microfinance Loan Management System

A robust microfinance loan management system is central to any successful microfinance operation. These systems automate the entire loan lifecycle, from application to disbursement and repayment. This automation not only speeds up loan processing but also ensures fewer errors and better record-keeping.

In India, where microfinance plays a vital role in rural areas, a flexible loan management system that supports various loan types, such as group loans and individual loans, is critical.

2. Cloud-Based Microfinance Software

As MFIs look to scale their operations, cloud-based microfinance software has become an essential tool. The cloud provides seamless scalability, allowing MFIs to expand without investing heavily in on-premise infrastructure. Additionally, cloud solutions offer real-time access to data, enabling faster decision-making and greater operational transparency.

The best microfinance software in India also ensures that data is stored securely in the cloud, reducing the risk of data breaches while maintaining compliance with India’s financial regulations.

3. Microfinance Accounting Software

Accounting is a critical function for any financial institution, and microfinance accounting software simplifies this process. By automating financial statements, balance sheets, and cash flow reports, the software enables MFIs to manage their finances more effectively. This integration between accounting and loan management provides a holistic view of the institution’s financial health.

Having an accurate and up-to-date accounting system also aids in better decision-making and long-term financial planning, which is crucial for any growing MFI in India.

4. Risk Management and Compliance Tools

Risk management is an essential aspect of microfinance. Microfinance risk management software helps MFIs assess and mitigate potential risks associated with loans and investments. With built-in risk assessment tools, these software platforms can evaluate borrower profiles and generate risk scores, enabling institutions to make informed lending decisions.

Additionally, with ever-changing regulations, microfinance compliance software ensures that institutions stay up to date with legal requirements, reducing the risk of penalties and non-compliance.

5. Digital Microfinance Solutions

In the digital age, customers expect quick and convenient service. Digital microfinance software allows institutions to offer their clients a seamless experience, from applying for loans to making payments. Whether it’s through a web platform or a mobile app, these solutions make it easy for customers to interact with their microfinance institution anytime, anywhere.

Mobile-based solutions are particularly important in rural India, where access to banking infrastructure is limited. Mobile-based microfinance software solutions enable customers to apply for loans, check their account status, and make repayments through their smartphones, thereby enhancing financial inclusion in remote areas.

Why Microfinance Software is Crucial for MFIs in India

India is home to a large population of individuals who are underserved by traditional financial institutions. Microfinance institutions play a critical role in bridging this gap, and Latest microfinance software helps these institutions operate efficiently and serve more clients.

1. Increasing Scalability

As microfinance institutions grow, so do their operational demands. Cloud-based microfinance software allows institutions to scale quickly without needing costly infrastructure. This means MFIs can expand their reach into new regions, providing services to more clients without sacrificing operational efficiency.

2. Enhancing Operational Efficiency

By automating routine tasks such as loan processing, accounting, and compliance, microfinance software reduces human error and frees up staff time for more strategic activities. This increase in efficiency allows MFIs to process more loans with fewer resources, ultimately driving growth and profitability.

3. Improving Financial Inclusion

One of the most significant benefits of adopting microfinance software is its role in advancing financial inclusion. Digital microfinance solutions and mobile-based microfinance software make it easier for individuals in rural areas to access financial services. Whether through mobile apps or cloud-based platforms, these tools ensure that even the most remote communities can benefit from microfinance services.

4. Ensuring Compliance

India’s microfinance sector is heavily regulated, and staying compliant with the latest laws is a challenge for many institutions. Microfinance compliance software helps MFIs stay ahead of regulatory changes, reducing the risk of fines or penalties. This software automates compliance tracking and generates reports, ensuring that institutions always meet legal requirements.

5. Providing a Seamless Customer Experience

The success of any financial institution depends heavily on customer satisfaction. Microfinance CRM software enables MFIs to manage customer relationships more effectively by tracking interactions, personalizing services, and automating communications like loan reminders. By offering a better customer experience, institutions can improve retention and encourage repeat business.

Choosing the Right Microfinance Software for Your MFI

Selecting the right microfinance software for your institution is a critical decision. It’s important to choose a solution that aligns with your institution’s goals and operational needs. Here are a few factors to consider:

- Scalability: Look for cloud-based microfinance software that can grow with your institution.

- Features: Ensure the software includes critical tools like loan management, risk management, and accounting.

- Compliance: Choose a solution with robust compliance software that keeps your institution up-to-date with regulatory requirements.

- Customer Experience: Opt for software with integrated CRM tools and digital capabilities that enhance the customer experience.

Conclusion

The future of microfinance in India is bright, and microfinance software is at the heart of this transformation. By adopting advanced tools like microfinance loan management systems (https://microfinancesoftware.co.in/), cloud-based solutions, and digital microfinance platforms, institutions can better serve their clients, improve operational efficiency, and stay compliant with regulations.

In an era where financial inclusion is more important than ever, investing in the right microfinance software solutions can empower your institution to expand its reach, offer more products, and provide better service to your customers.